Personal loans are the fastest-growing debt category in the United States. This segment has grown the most within the online loan category due to its ease and accessibility. In 2018, online lenders handled 36% of all personal loans. Unfortunately, along with the rise of personal loans, there has been a surge in online payday loans.

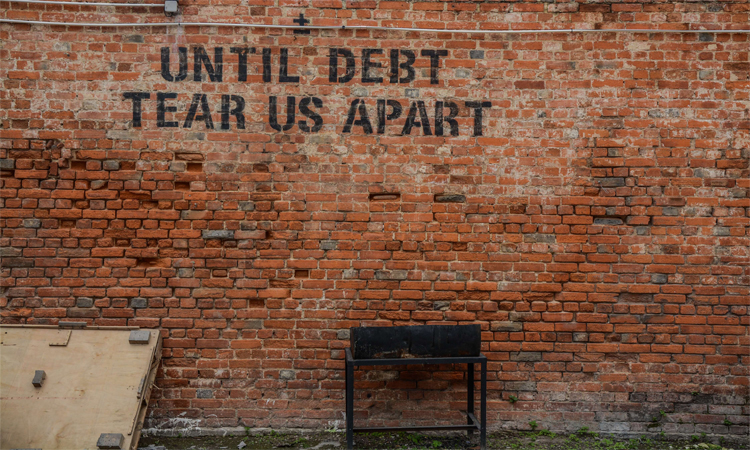

A good portion of Americans live paycheck to paycheck. According to the Federal Reserve, 40% of Americans don’t have $400 in savings to cover the cost of fixing a heater or repairing a car. When a medical or family emergency hits, many people turn to an online payday loan for fast cash, instead of seeking a low-cost, online personal loan. This is a potentially damaging financial decision since a small payday loan has the potential to balloon into major debt and even bankruptcy.

What are Payday Loans?

Payday loans, also known as paycheck loans and cash advances, are short term loans meant to be paid in two weeks. The online loan payment usually links to the borrowers checking or savings accounts. (Storefront payday loan operations may require borrowers to submit a check with a post-date, which is deposited two weeks after the loan is made). These are high-interest loans for small amounts of money which the borrower arranges to pay back when they receive their next paycheck. Targeting the working poor cash advance stores are usually found in low-income neighborhoods across the country with colorful banners declaring “Fast Cash” and “Cash4You.”

The Dangers of Payday Loans

In many states, there are laws against creating personal loan agreements in the marketplace at a usury or “loan shark” level, but somehow payday loans continue to take advantage of a financially vulnerable population. These loans have long preyed on black and Latino communities and working-class workers.

Community-based advocates are seeking to have payday loans banned from their states to end the cycle of debt which these loans encourage. Lawmakers in Indiana and other states are pushing legislation which will put a stop to payday loans or shark loans. But due to a strong lobbyist presence supporting the interests of lenders in Washington, D.C., unscrupulous loan operations are still able to target struggling citizens with extraordinarily high rates and fees.

However, at the Federal level, there are no longer any legislation or consumer bureau efforts to do away with predatory lending practices of payday loan companies. In recent headlines, regulations meant to control the actions of payday lenders have been gutted, leaving this questionable industry to continue unchecked.

5 Reasons to Avoid Payday Loans:

- Payday Lenders Can Charge Over 40% For A Short Term Loan

For a small loan, an online payday loan can charge exorbitant fees and interest. For example, if $400 is borrowed, over $560 will be due in two weeks. If another two-week loan is issued in a rollover, the amount will soar to $784. The amount due grows exponentially. In response to this people get trapped in a cycle of borrowing and borrowing – never having enough to pay it all off.

- Debt Balloons From The Average Payday Loan

These lenders target low-income customers much like a street corner loan shark would. Once a new customer gets a payday loan (which they cannot afford), they opt for getting another loan (and another) each payday – until their debt soars into sums three times greater than the amount they originally borrowed.

Some loans have an annual percentage rate of 400% or more. Most working poor borrowers are not able to pay this kind of money back. They become trapped in the debt traps of usury lending. Anti-usury laws are on the books in many states, but due to the power of the lending lobby, the practice of unscrupulous cash advance loans continues.

- A Checking Or Savings Account Can Be Automatically Drained Of Funds

If a payday loan is linked to a bank account, the lender can automatically garnish the account – potentially leaving the consumer with no money for living expenses, like rent or food. Many customers are shocked to find fees, charges and high-interest rates have wiped out their checking and savings accounts.

- Additional Fees And Charges Are In The Fine Print Of Payday Loan Agreements

High fees and extra charges are hidden in the details of a loan agreement. For example, payday lenders will charge $10 or more for each day payment of the loan is late. Default fees (if the loan is not paid on the due date) are twice the amount borrowed. Borrowers are severely penalized adding to a daily increasing debt load.

- Payday Lenders Make No Effort To Make Payment Arrangements With Their Clients When They Fall Behind

Most traditional lenders, such as brick and mortar banks and credit card companies, will try to work out installment plans with their borrowers if they fall behind on payments. This is not the case with payday loan companies. They don’t have a policy which supports getting customers back on track.

Low-Cost personal loans: the best alternative to payday loans

When trying to get cash to cover emergency expenses, a consumer’s best bet is to apply for a reputable lower-cost online personal loan. Instead of going into a financial tailspin with cash advance loans, borrowers should try to secure a small online loan with a relatively modest annual percentage rate.

Be the first to comment on "5 Reasons to Avoid Payday Loans Online"